The hot-button issue this month is that rate notices arriving in the letterboxes of many Hawkesbury ratepayers show that their rates have risen sharply, while other suburbs have had a modest decrease. And by “risen sharply”, I mean doubled or tripled from this time last year. The worst example I found was a property at Pitt Town now paying over six times the rate of an average property compared to last year.

Most residents accept that paying tax (in this case, Council rates) is necessary to provide the services people expect. However, many community consultation meetings (and last Tuesday’s Council meeting) were full of ratepayers who are visibly angry at what they feel is a betrayal of the principle everyone pitching in equally; the Aussie notion of a “fair go”.

So are some people now bearing a disproportionate burden of Council rates? I and my fellow Liberal Councillors think some are, and we’ve tried to do something about it.

What’s happened is a triple-whammy of changes and proposed changes, and it’s been challenging to educate the public about the contribution of each part.

Here’s how to understand what’s happened.

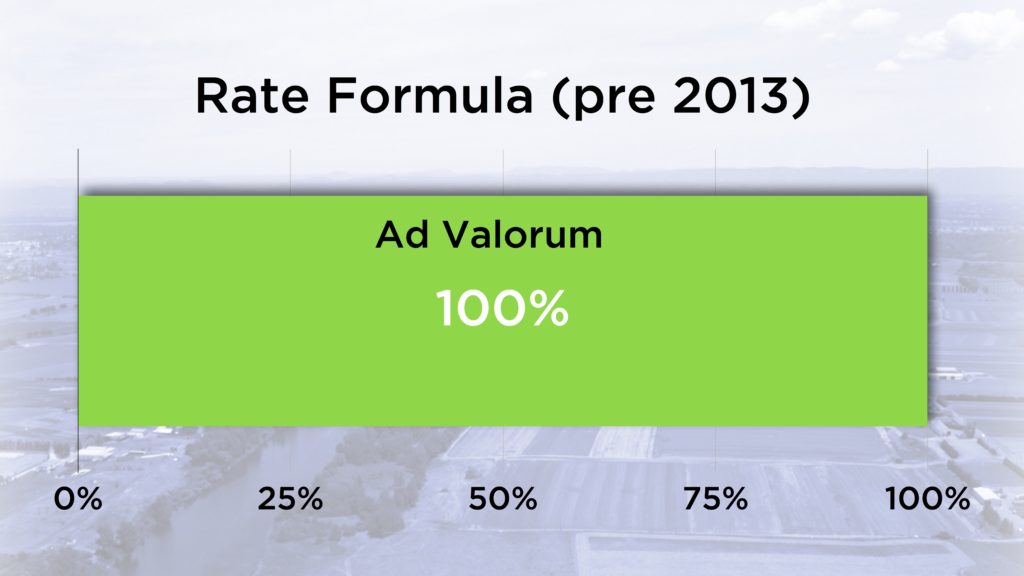

Prior to 2013, your Council rates were calculated entirely on your land value. This is called the “Ad Valorum” approach (Latin for “according to the value”). This of course meant that if your land value rose sharply, your rates reflected that rise very directly.

The Liberal-lead Council instituted a change in 2013 that introduced what’s called a “Base Rate” of 50%, meaning that there was a standard charge paid by everyone, and that the remainder of rates Council collected based on land value was also 50%.

The Liberal Council regarded that as a reasonable and democratic change to make, and it resulted in an “evening out” of rates paid by both residential and rural-residential landowners. Rural-residential properties frequently are situated further from common resources in the towns, and endure worse roads, a lack of kerb and guttering, poorer street-lighting, and other disadvantages. Of course, the 2013 change resulted in some rates rising and some falling, but the changes were calculated to be moderate, and not extreme, unlike the most recent changes.

In September 2016, a majority of the Councillors elected to Hawkesbury Council were Independents, Labor and Green. The four Liberal Councillors are now outvoted by the 8 Councillors in this decidedly left-wing alliance.

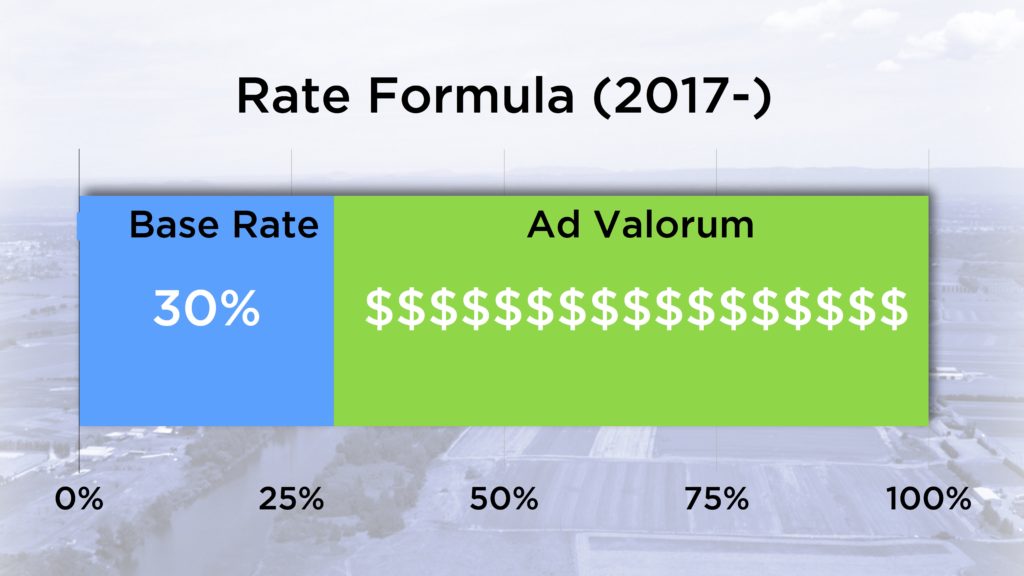

This year, the new Council decided to change the formula again and reduce the base rate to 30%, and consideration is being given to a Special Rate Variation (SRV) that will put everyone’s rates up by more-than-rate-pegging if the proposals currently before us are endorsed by the Council and then by IPART.

Your Liberal Councillors voted against this change. The reduction of the Base Rate to only 30% means that people experiencing a spike in land value are more heavily hit.

It is not the purpose of this article to argue the case for or against the SRV, as that is more complicated.

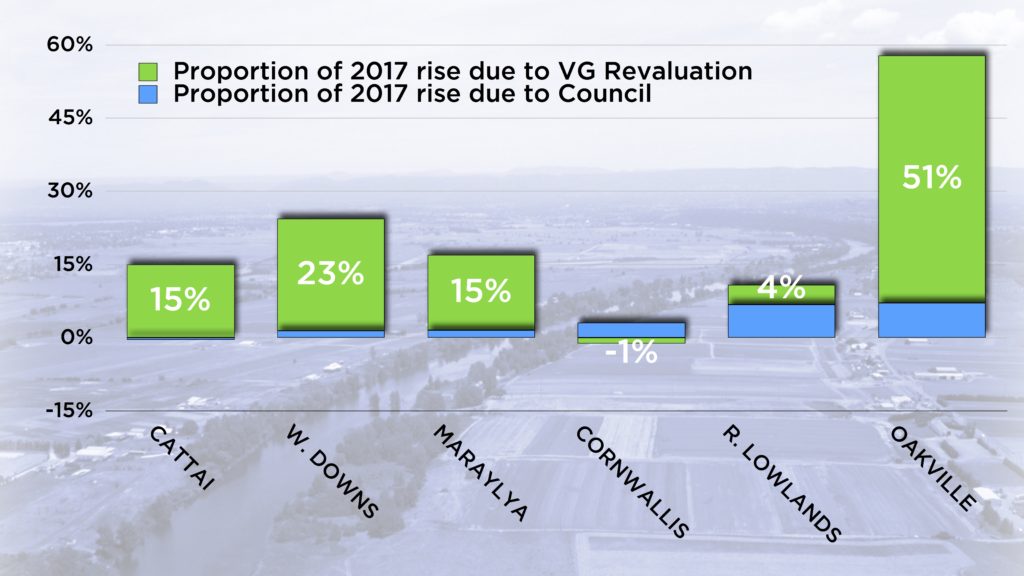

Enter, the Valuer General. Land values in a range of suburbs across the district have changed sharply in the most recent round of valuations (which generally occur once every four years).

The area in which I live, in Oakville, has been particularly hard hit, with the average rate rise of 57%, and with some property owners very much harder hit than that.

Frankly, the Valuer General has erred in valuing the land in Oakville in the way that it has. It has erred because land value should reflect the prospective “subdividability” (if I might coin a word) of land, and of course there is no prospect of landowners in Oakville being able to subdivide their land at all in the near future. The land valuations are calculated on recent real-estate sales figures, and this isn’t the same thing. Very heavy development is occurring on the other side of Boundary Road in the Hills LGA, and this has artificially skewed the figures in a highly disadvantageous way to Hawkesbury residents whose income has not risen magically to keep pace with their land value. I am heartened to hear that the Valuer General will be visiting the Hawkesbury to meet with residents and my hope is that they will be willing to revisit their valuation processes instead of simply coming with the attitude of only explaining but not changing their conclusions.

At the Council meeting on Tuesday 8th August, the gallery was packed with residents supporting a Liberal resolution to re-visit the rating formula and to apply pressure to the Valuer General to explain their decision. This motion was opposed by Mayor Lyons-Buckett and the independent-Labor-Green alliance and substituted with a significantly watered down motion that effectively called for no action to be taken on the base rate.

This was disappointing, and rural-residential landowners badly affected by both the change in formula and the Valuer General’s decision will continue to be hardest hit.

I and your Liberal Council representatives will continue to listen and represent your concerns, right up to the next Council elections.

-Councillor Zamprogno.