Being a good local government representative means understanding the landscape that Councils inhabit, and the way we interact with other tiers of government. So, it’s well to pay attention when the State Government announces potential shifts in policy.

Constitutionally, Local Government does not exist. This is despite a decades long campaign, which I support, for constitutional recognition. There was a failed referendum in 1988. More recently, the Labor federal government promised another in 2013, which I believe would have passed with bipartisan support, only for them to welch at the last minute.

I’ve always believed in the principle of subsidiarity, which suggests that decisions in government should be taken by the level that is closest to the people affected. In my opinion devolution, rather than the endless accumulation of power to higher or more centralised authorities, is not only more efficient, more democratic, but also more consonant with classical Conservative principles of government.

However, any administrative or regulatory function held by government has to be paid for. Unfortunately, ‘cost shifting’ has moved the responsibility for a huge amount of regulation, infrastructure, planning and service delivery – previously provided by other tiers of government, on to local Councils like ours, and thus to our ratepayers, without the ability to pay for it. A 2018 LGNSW report concluded this cost NSW Councils (and again, ratepayers) over $6.2 Billion of extra costs between 2006 and 2018. Hawkesbury Council estimated the cost to us was $6.9 Million in one year alone.

So against this backdrop, I was interested when this morning NSW Treasurer Dominic Perrottet launched the NSW Productivity Commission’s ‘White Paper’ into rebooting the economy. I tuned in for the Treasurer’s speech. The report makes for interesting reading, and I’ll pick just a couple with relevance to Councils like ours.

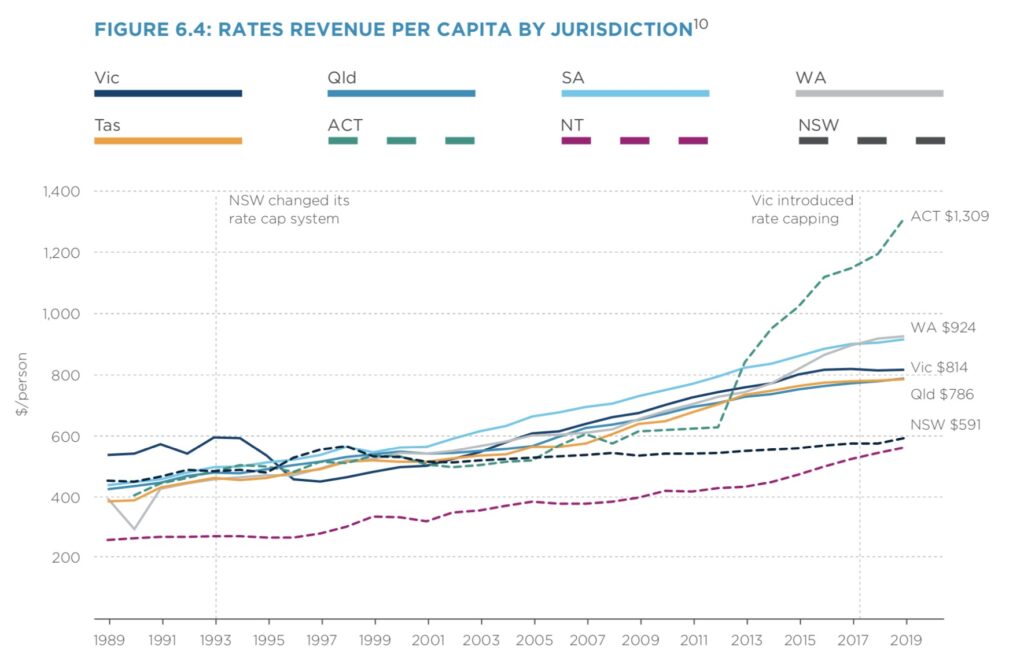

One graph in it shows how the ‘rate peg’ has suppressed local government income since it was introduced in 1993.

This presents a mixed picture. In my time on Hawkesbury Council, I have been strong on ensuring Council lives within its means. I opposed the rate rises the dominant ruling block imposed on the community, as well as the changes to the rating formula that concentrated the rating burden unfairly on particular ratepayers.

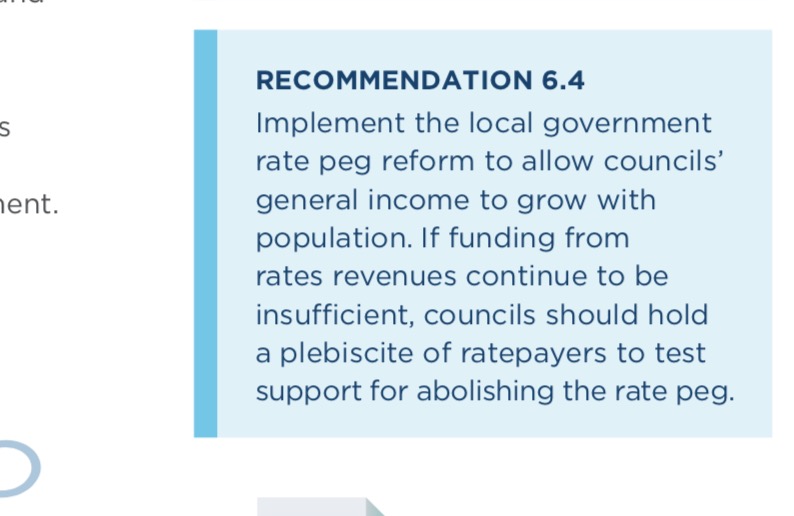

But it also shows that this government policy has deprived Councils across the state of the ability to grow their revenue to pay for cost-shifted responsibilities in anything like the way Councils have in other states, to keep pace with inflation, population growth, or rising regulatory or infrastructure costs. The White Paper suggests that the rate peg should be abolished, or at least varied to allow Councils to better account for population growth.

No one wants Councils to overcharge their ratepayers. Equally, most people agree the State government cost shifting to Councils without providing the revenue to pay for it is unfair. Any policies flowing from the White Paper will need to ensure that abolition of the rate cap doesn’t act as a green light for Councils to just jack up their rates. I think most people in the Hawkesbury don’t think Council is doing the best with what they are already collecting.

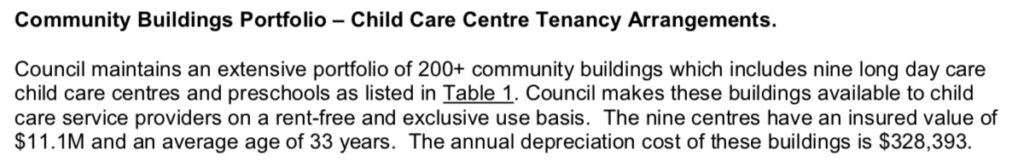

The white paper also suggests that Councils should to abide by principles of ‘competitive neutrality’, when it engages in commercial conduct that may disadvantage other local businesses that operate in the same domain. The example it cites is Councils that run Child Care centres. As it happens, there are nine different child care centres operating in Council owned properties around the Hawkesbury, who enjoy a substantial subsidy. This report presented to Council in October 2018 says it best:

The white paper makes this recommendation on p169:

My own view is that the various childcare centres around the district are worth supporting, and the ‘subsidy’ of facilities run from Council properties (effectively, an opportunity cost to Council in terms of foregone revenue) provides a direct and valued support to the community. I believe Council addressed the issue of centres taking an unfair advantage over their fully commercial competitors when it inked an agreement to ask those providers to contribute to a multi-year ‘building renewal fund’ to acknowledge the benefit they received from operating from Council properties, amounting to $1.5M over the life of the agreement.

I am glad that the NSW Government has been so effective in supporting our State economy during the worst economic dislocation for generations. This White Paper is not a policy manifesto, nor is it legislation. It’s the start of a conversation, and a very timely one about how to continue economic reform and streamline co-operation between local government and the State.