NSW Valuer General

New land valuations give little relief for rates in most Hawkesbury suburbs

Residents around the Hawkesbury should be receiving their latest land valuation letters from the Valuer General. I got mine this week.

I'll be making a more detailed analysis when some details crystallise, but since it's already been mentioned on social media, let me get some data out to you.

Every few years, the VG revalues your land. It has nothing to do with the improved value of your property (that is, with your house and other structures), but is used by Council to calculate your rates. This Council voted to turn the knob up on the formula which magnifies swings in land value on your rates. I and my fellow Liberal Councillors opposed that as unfair and this remains our view. I've made several videos and posts about this in the past, if you want a reminder.

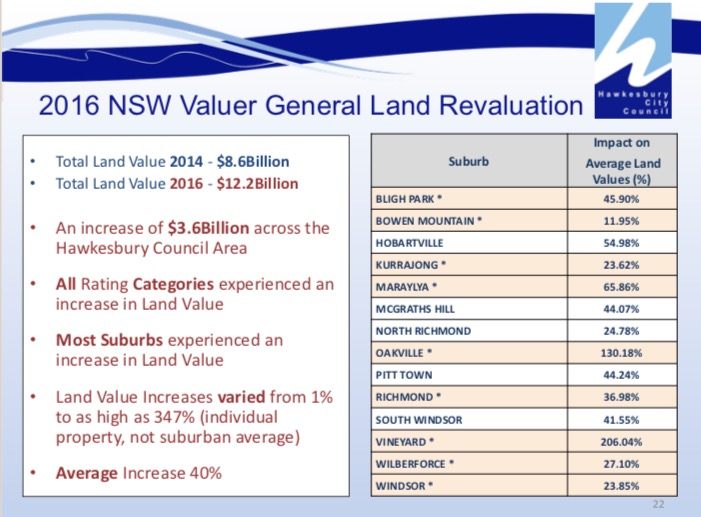

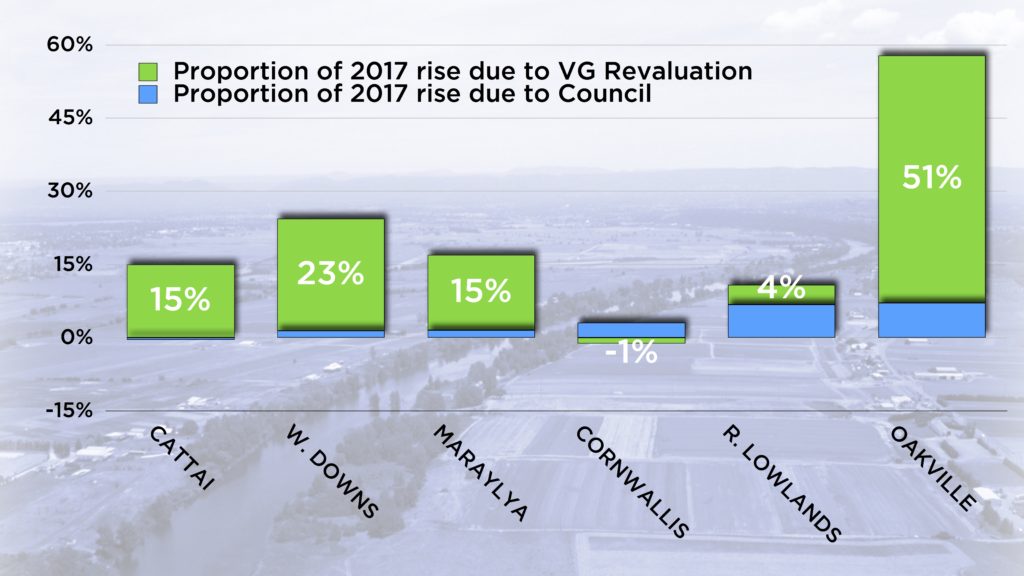

For example, speculation caused by development near the NW growth sector caused land values in Oakville and Vineyard to soar in 2017, and the Council rubbed salt in the wound by applying for a staged 31% rate-hike (the SRV) which is still flowing through to you.

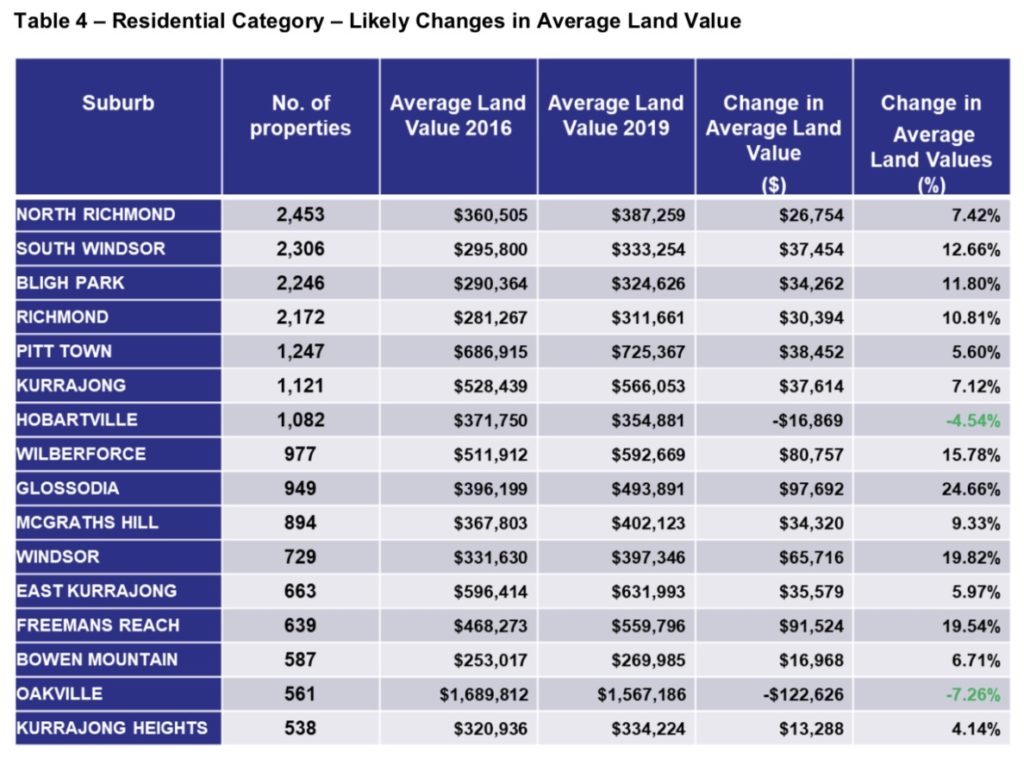

Here are three tables from Council's new 2020 analysis of the effect of the new valuation on rates, by suburb.

It shows that land values in Oakville have relaxed -7.26%, the biggest suburb drop in this round. However, given land values spiked 130% in the 2016 Valuation (206% in Vineyard, 66% in Maraylya, and 44% in McGraths Hill), this is little relief.

If this were the only factor, the average Residential rates in Oakville would drop $710p.a in the 2020-2021FY.

BUT, since the latest stage of the SRV is also going to be applied to your next rates bill, most of the gains are eroded.

So, the average rates in Oakville in 2020-21 will be $3598pa, down from $3905 this year, a saving of only $307.

These figures need to be taken with these caveats:

• Average figures are only that, and your own situation may differ.

• I've asked Council staff for more granular data including median rates, and I'm still waiting for them.

• These per-suburb figures are not final, as the VG has indicated some variations may occur in areas affected by the fires. This will affect the balance between suburbs and therefore the proportion each of us will pay.

Some people's rates in Oakville and elsewhere doubled (or worse) in 2017, and this new land valuation will give you very little relief. You're right to be angry. The current Council delivered a quadruple-whammy to you by abolishing the Rural-Residential category, increasing land value as an input to the rating formula, spiking everyone's rates by 31%, all at a time of rampant land value property speculation, which appears to be continuing.

I will continue to advocate for a fairer system.

Hawkesbury landowners get extended deadline for review of their land value

"In this episode, a climactic meeting with the Valuer General, plans to secede from the Hawkesbury, and a ray of hope for people who have endured massive rate rises, but only if you act now.

In my last video I described how thousands of Hawkesbury ratepayers have been hit with a big rise in their Council rates. I described how the 23% of our landowners whose rates have gone up, are now paying 35% of Council rates, and how that just isn’t fair.

I explained how the biggest part of that rise came from changes to land value as calculated by the Valuer General. An important development has occurred recently that you need to know about.

Hosted by Council, a representative from the Valuer General’s office came to a very well attended meeting at the Windsor Function Centre on August 30th.

Present were hundreds of angry ratepayers, stung by the rise in their rates, and who generally had not availed themselves of the opportunity to apply for a review of their excessive land valuation before the 60 day cutoff – the period that began after everyone received their valuations earlier this year.

At that meeting, the Valuer General made two concessions. The first is that Hawkesbury Residents have now had the deadline extended, and they can apply for a review of their land valuations until the end of September 2017.

If you live in the Hawkesbury and your rates have gone up, I strongly suggest that you apply to ask for a review of your land valuation.

The details of how to do that are at the link on the Valuer General’s website. My hope is that if enough people do this, some pressure can be brought to bear.

The second concession was that no landowner asking for a review in this round will have their land valuation put up. This is important because when you ask for a review, it could go down or up, and this makes the process of asking for a review a no-risk proposition.

However, unless you cite the right reasons, your application for a review may fail.

“I don’t like this” or “I’m on fixed income and can’t afford to pay” aren’t likely to get much traction, even if they’re true.

As I see it, there are three grounds for review, especially if you live in the Oakville, Maraylya, or Vineyard area.

The first is that real-estate values are being distorted by adjacent development caused by the North West Growth Sector.

Of course, one riposte may be that, even so, they are current the real-estate sales values, and that the Valuer General’s is merely applying their formula, and that’s that.

However, residents attending the meeting at Windsor were alarmed to find that only around ten sales in the area were used to define the values for the whole suburb, which is over 1200 properties in Oakville, Maraylya and Vineyard. This sample space is too small to be representative. Similar properties are grouped together into statistical units called Components. Nearby components separate to the Oakville component are cheaper, despite both containing acreage properties with similar aspects and uses. In my opinion, the Valuer General’s methodology is flawed.

My second concern is that land value should be reflective of what people can do with it. This instructive video from the Valuer General acknowledges that things like whether the land is sloped, or has an ocean view, has good soil, or is subdividable, all affect land value. Overwhelmingly, your land that has risen in value so sharply can only be put to the same use that it could be put a year ago, and no subdivision is in prospect. The Valuation of Land Act states that land must be valued according to its “highest and best permitted use”. But what happens when land is bought, at inflated prices, on the basis of speculation that it will be rezoned in the future for a different purpose?

The Valuer General should be prudent enough to mitigate against the effects of speculation in the market.

The third concern is that the Valuer General should acknowledge that changes as severe and rapid as this are socially and politically intolerable.

When you think about it, there is some precedent here. Look at what happened with the recent Fire and Emergency Services Levy.

You will recall this was introduced with great fanfare by the State Government in December 2015, only to be withdrawn in July this year, precisely because the government’s modelling was flawed. When it came out that the change in tax to many property-owners, based on land valuations from the Valuer General, were too steep, too unfair and too rapid, the whole program was put on hold.

Political intervention was justified there, and is here too, and for exactly the same reasons.

Your Liberal Councillors, including myself, have stood up for Hawkesbury residents on two fronts. To the degree that Council can affect change, we will continue to push for it, all the while continuing to bring these concerns before our State colleagues as well.

I’ll end by answering a remark I’ve heard at more than one community meeting. Ill-feeling is bad enough among some to suggest that parts of the Hawkesbury feeling this financial pain should secede from the Hawkesbury and apply to join the Hills Shire, or that the whole question of amalgamation between the Hawkesbury and the Hills be re-opened.

I’m not sure what you’d call that. Following the model of Brexit, should it be Hawkes-xit? Oaks-xit?

Frankly this is a nutty idea. Firstly, Hills Shire council never saw a development they didn’t like, and if you want the whole of the Hawkesbury to look like Rouse hill or Kellyville, then… please see your GP to change your medication.

Secondly, you would be no better off. The Hill’s rating structure is not so different to our own. To join the Hills Shire, where people may or may not eat their babies, would be at best a Faustian bargain that we would regret.

The Hawkesbury is a special place, and it deserves to stand on its own and determine its own destiny. I regard our corner of the world as a bulwark against the encroachment of what I call ant-hill Sydney. It is a valuable region of the greater Sydney area that is still most valuable for its amenity, open space, agriculture and heritage. If people can’t afford to live on acreage allotments because the rating structure is unfair, those on Council who have engineered this change might care to accept some of the blame when landowner’s thoughts turn to selling up to developers.

Video blog - Hawkesbury Council rate rises and the Valuer General

Further to an earlier post on Hawkesbury Council's rates rises, I've done some further analysis on the factors contributing to sharp rate rises for many Hawkesbury ratepayers, especially those in Oakville, Maraylya and Vineyard.

The maps referenced in the above video can also be downloaded here.

Remember, subscribe, like and share for updates!

Are some Hawkesbury residents paying too much tax?

The hot-button issue this month is that rate notices arriving in the letterboxes of many Hawkesbury ratepayers show that their rates have risen sharply, while other suburbs have had a modest decrease. And by "risen sharply", I mean doubled or tripled from this time last year. The worst example I found was a property at Pitt Town now paying over six times the rate of an average property compared to last year.

Most residents accept that paying tax (in this case, Council rates) is necessary to provide the services people expect. However, many community consultation meetings (and last Tuesday's Council meeting) were full of ratepayers who are visibly angry at what they feel is a betrayal of the principle everyone pitching in equally; the Aussie notion of a "fair go".

So are some people now bearing a disproportionate burden of Council rates? I and my fellow Liberal Councillors think some are, and we've tried to do something about it.

What's happened is a triple-whammy of changes and proposed changes, and it's been challenging to educate the public about the contribution of each part.

Here's how to understand what's happened.

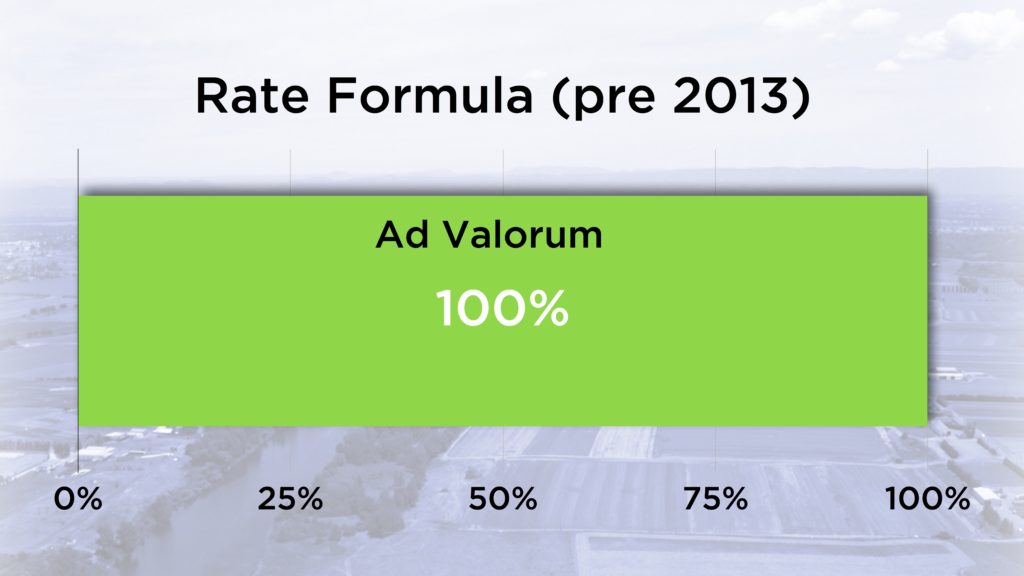

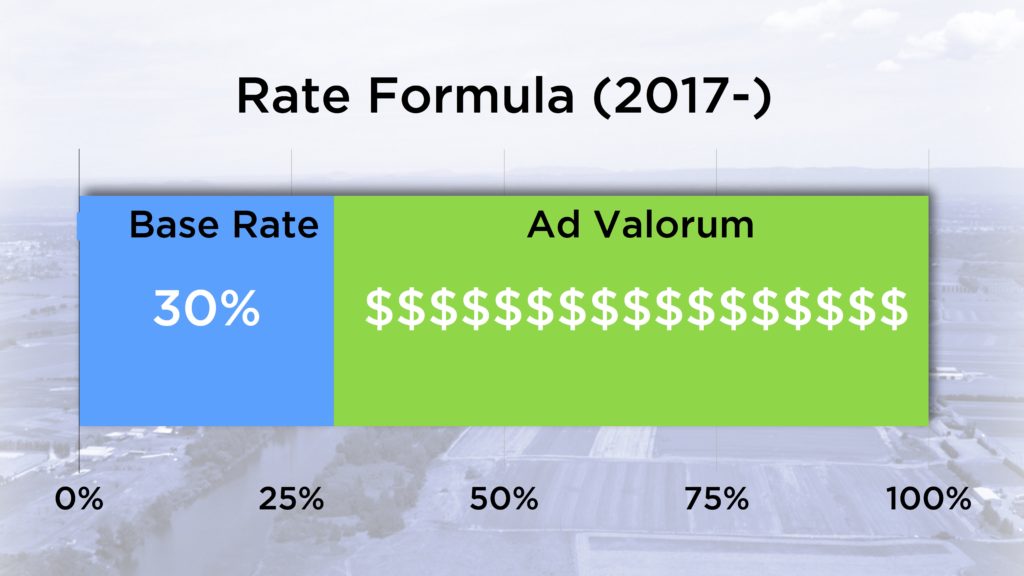

Prior to 2013, your Council rates were calculated entirely on your land value. This is called the "Ad Valorum" approach (Latin for "according to the value"). This of course meant that if your land value rose sharply, your rates reflected that rise very directly.

The Liberal-lead Council instituted a change in 2013 that introduced what's called a "Base Rate" of 50%, meaning that there was a standard charge paid by everyone, and that the remainder of rates Council collected based on land value was also 50%.

The Liberal Council regarded that as a reasonable and democratic change to make, and it resulted in an "evening out" of rates paid by both residential and rural-residential landowners. Rural-residential properties frequently are situated further from common resources in the towns, and endure worse roads, a lack of kerb and guttering, poorer street-lighting, and other disadvantages. Of course, the 2013 change resulted in some rates rising and some falling, but the changes were calculated to be moderate, and not extreme, unlike the most recent changes.

In September 2016, a majority of the Councillors elected to Hawkesbury Council were Independents, Labor and Green. The four Liberal Councillors are now outvoted by the 8 Councillors in this decidedly left-wing alliance.

This year, the new Council decided to change the formula again and reduce the base rate to 30%, and consideration is being given to a Special Rate Variation (SRV) that will put everyone's rates up by more-than-rate-pegging if the proposals currently before us are endorsed by the Council and then by IPART.

Your Liberal Councillors voted against this change. The reduction of the Base Rate to only 30% means that people experiencing a spike in land value are more heavily hit.

It is not the purpose of this article to argue the case for or against the SRV, as that is more complicated.

Enter, the Valuer General. Land values in a range of suburbs across the district have changed sharply in the most recent round of valuations (which generally occur once every four years).

The area in which I live, in Oakville, has been particularly hard hit, with the average rate rise of 57%, and with some property owners very much harder hit than that.

Frankly, the Valuer General has erred in valuing the land in Oakville in the way that it has. It has erred because land value should reflect the prospective "subdividability" (if I might coin a word) of land, and of course there is no prospect of landowners in Oakville being able to subdivide their land at all in the near future. The land valuations are calculated on recent real-estate sales figures, and this isn't the same thing. Very heavy development is occurring on the other side of Boundary Road in the Hills LGA, and this has artificially skewed the figures in a highly disadvantageous way to Hawkesbury residents whose income has not risen magically to keep pace with their land value. I am heartened to hear that the Valuer General will be visiting the Hawkesbury to meet with residents and my hope is that they will be willing to revisit their valuation processes instead of simply coming with the attitude of only explaining but not changing their conclusions.

At the Council meeting on Tuesday 8th August, the gallery was packed with residents supporting a Liberal resolution to re-visit the rating formula and to apply pressure to the Valuer General to explain their decision. This motion was opposed by Mayor Lyons-Buckett and the independent-Labor-Green alliance and substituted with a significantly watered down motion that effectively called for no action to be taken on the base rate.

This was disappointing, and rural-residential landowners badly affected by both the change in formula and the Valuer General's decision will continue to be hardest hit.

I and your Liberal Council representatives will continue to listen and represent your concerns, right up to the next Council elections.

-Councillor Zamprogno.